- Buy & Build Europe

- Posts

- Buy & Build Europe #57

Buy & Build Europe #57

Your Weekly <5 Minute Update of ETA, Search Funds, HoldCos

In partnership with

❤️ Thanks to everyone who brought our newsletter to the attention of new readers last week. The “share function” can be found at the end of the email. Today’s newsletter counts 989 words and takes about 4.0 minutes to read.

In case you missed out on our last episode, please find it here.

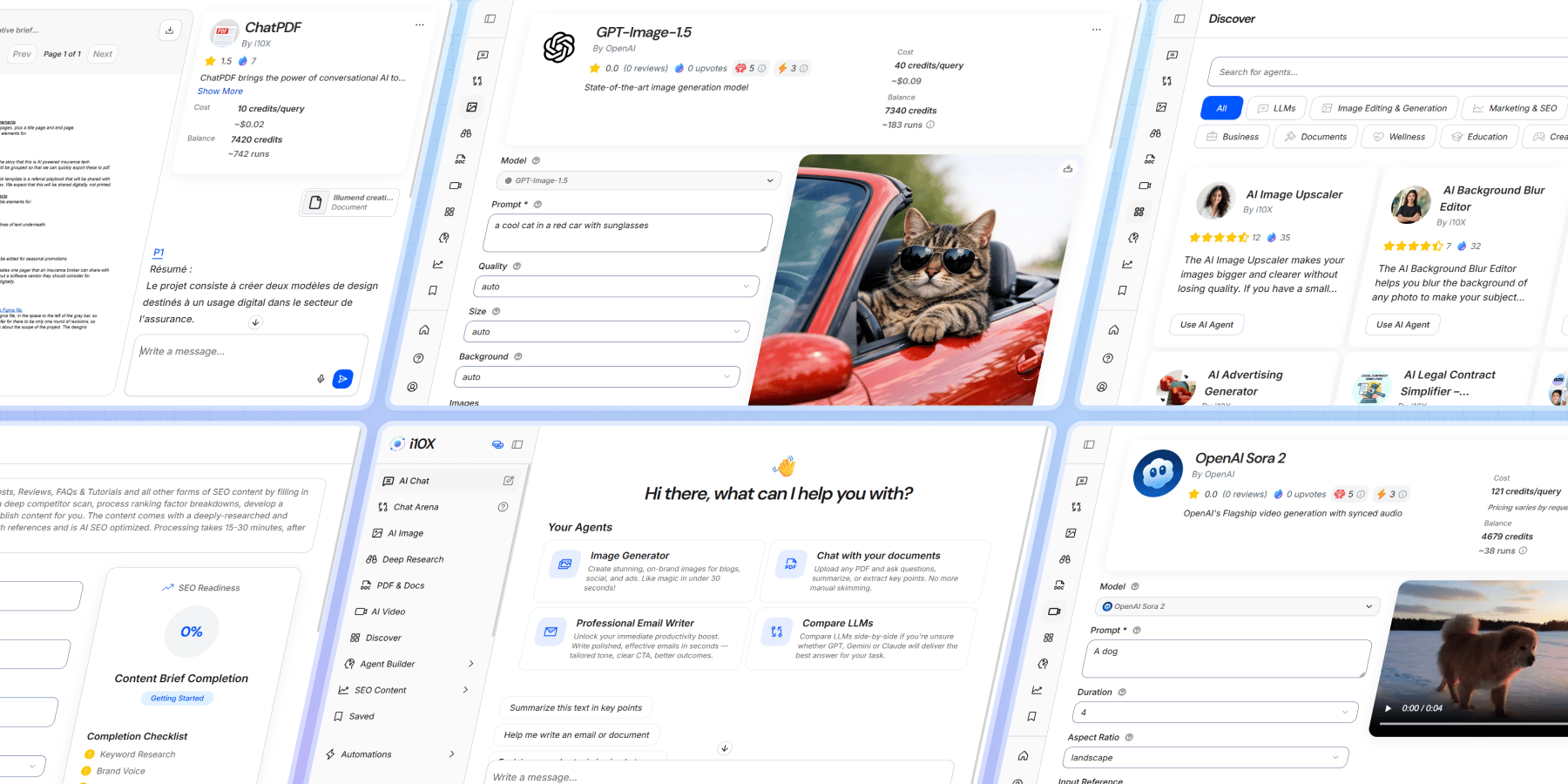

i10X: Supercharge Your Buy & Build Strategy with AI - All in One Place

i10x.ai is the ultimate AI Agent Marketplace, delivering 500+ specialized tools in a seamless workspace. Powered by GPT-5, Claude, Gemini, and Grok, it's designed for ETA searchers, HoldCo operators, and entrepreneurs to automate workflows, cut costs, and scale faster. Say goodbye to juggling multiple subscriptions - get unlimited access for just $25/mo and save 90%.

With i10x.ai:

Instantly generate business plans, market research, and financial models for acquisitions.

Optimize pitch decks and simplify legal contracts with AI agents.

Automate due diligence, competitor analysis, and growth strategies in minutes.

Boost productivity for solopreneurs and teams - join 100k+ users transforming their operations.

Start your free trial today at i10x.ai and 10x your efficiency.

Today’s Rundown

Building a career through the search fund model

Mathematical analysis of value-creation attribution in search funds

Search fund pre-LOI investment analysis

3 deal / launch announcements

Weekly Highlights

auilium shared a new podcast episode with Henrik Buehler on building a career through the search fund model:

Emotions drive M&A outcomes more than most buyers admit: ~50% of B2B buying decisions and ~95% of consumer decisions as emotion-driven, and argues the same dynamics apply in succession deals - often making continuity/culture decisive even when price is competitive

Europe search funds are scaling fast, with measurable momentum: ~1,000 search funds raised globally, with ~650 in North America and ~350 outside, and “most” of the non-NA activity in Europe

Germany is still early but building infrastructure: the discussion estimates ~20–30 active searchers/duos (mostly traditional model; self-funded harder to track) and notes ~50 chambers of commerce each now having a succession-focused person, reflecting how central succession has become

Deal size expectations are drifting upward due to capital supply: typical targets are ~€1–4m EBITDA, but an example is given of a German searcher acquiring ~€8–10m EBITDA using a large syndicate - linked to broader “dry powder” pressure

Target “quality” is defined with guardrails that reduce early-operator risk: prioritizing recurring/repeat B2B revenue, EBITDA margins ideally ≥15%, and room for mistakes + reinvestment; SaaS is potentially attractive on revenue quality but often challenging on entry valuation and multiple arbitrage

Search execution is run like a sales funnel with cadence math: top-down thesis → database filtering → ~200-target lists → outreach via email/letters with 4 follow-ups over ~1 month (about every 7 days) because response rates rise with follow-ups

Co-founder risk is explicitly managed with process: ~65% of ventures fail due to co-founder conflict, and outlines mitigants: shared values/vision, clear role division, “hard feedback” culture, and a disagreement framework (surface perspectives → active listen → evaluate neutrally → seek consensus → post-mortem learning)

Key seller insight: many founders (especially €1–4m EBITDA) are first-time sellers; “process” can be disruptive and leak rumors; searchers win by offering stewardship (employees, culture, local reputation) and by plugging into the seller’s first advisor - often the tax advisor - before an auction process starts

Yale, in partnership with search fund Skyline Crest Partners, published a mathematical analysis of value-creation attribution in search fund projects:

Across 59 exited search fund investments representing roughly 35% of known exits, about 80% of enterprise value creation came from EBITDA multiple expansion while only 20% came from EBITDA dollar growth

EBITDA grew by roughly 60% on average, driven by revenue growth of more than 100 percent, but this was partially offset by EBITDA margins falling from about 25% at entry to 19% at exit

Nearly 90% of companies experienced EBITDA multiple expansion and more than half at least doubled their exit multiple, while only about 30% achieved any EBITDA margin expansion

Statistical analysis shows EBITDA multiple expansion is positively associated with revenue growth and firm size but negatively associated with margin expansion, suggesting that reinvestment and margin compression often correlate with higher exit valuations

The findings imply that search fund returns rely heavily on market timing, buyer demand, and exit process quality, making terminal multiple risk a dominant driver of IRR rather than operational margin improvement

Fontics launched a search fund pre-LOI investment analysis:

A structured Pre-LOI quantitative review that normally takes 5–10 hours can be compressed to under 60 minutes by standardizing the LBO build and automating scenario, sensitivity, and driver analysis, effectively cutting build and analysis time by about 90%

A disciplined one-hour workflow allocates roughly 30 minutes to extracting teaser inputs, 10 minutes to updating a pre-built LBO, and the remaining 20 minutes to identifying key value drivers, running scenarios, stress-testing structures, and reaching a go or no-go decision

Empirical experience from QoE providers suggests more than 90% of QoE reports adjust EBITDA downward, implying Pre-LOI EBITDA should be treated as an optimistic ceiling and reinforcing the need for fast downside-focused screening

In most deals, a small set of variables drives outcomes, with roughly 3–5 inputs explaining over 90% of MOIC or IRR movement, allowing searchers to focus scenario analysis and negotiations on a narrow set of high-impact levers

Small simultaneous changes across core drivers can materially shift returns, with examples showing that moving IRR from roughly 26% to 30% may require less than a 5% combined adjustment across revenue growth, leverage, margins, or structure rather than heroic single-variable assumptions

Deal / Launch Announcements

🇪🇸 Ignacio Jimenez de Laiglesia and Gonzalo Tomé Aróstegui launched Virrey Capital, a sector-agnostic search fund (link)

🇪🇸 Javier Sánchez Cordero and Aitor Grandes Gajate launched Scrum Capital, a sector-agnostic search fund (link)

🇩🇪 Frank Forster launched AQUEDUCT, a search fund and SME investor (link)

Any suggestions, questions, or criticism? Any topics that should be covered in the future? By answering this email, you’re sliding right into my inbox.