- Buy & Build Europe

- Posts

- Buy & Build Europe #55

Buy & Build Europe #55

Your Weekly <5 Minute Update of ETA, Search Funds, HoldCos

In partnership with

❤️ Thanks to everyone who brought our newsletter to the attention of new readers last week. The “share function” can be found at the end of the email. Today’s newsletter counts 1,055 words and takes about 4.5 minutes to read.

In case you missed out on our last episode, please find it here.

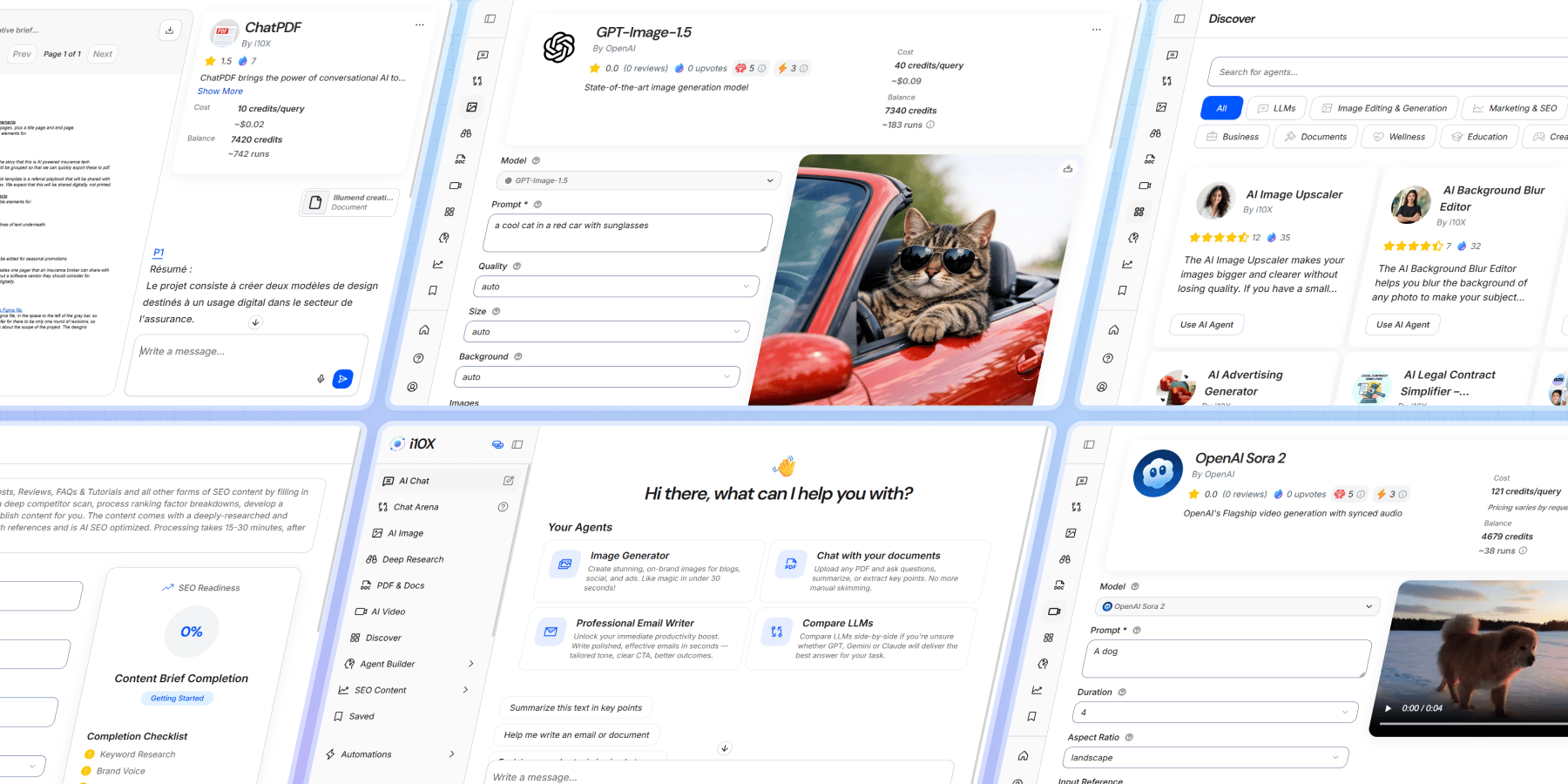

i10X: Supercharge Your Buy & Build Strategy with AI - All in One Place

i10x.ai is the ultimate AI Agent Marketplace, delivering 500+ specialized tools in a seamless workspace. Powered by GPT-5, Claude, Gemini, and Grok, it's designed for ETA searchers, HoldCo operators, and entrepreneurs to automate workflows, cut costs, and scale faster. Say goodbye to juggling multiple subscriptions - get unlimited access for just $25/mo and save 90%.

With i10x.ai:

Instantly generate business plans, market research, and financial models for acquisitions.

Optimize pitch decks and simplify legal contracts with AI agents.

Automate due diligence, competitor analysis, and growth strategies in minutes.

Boost productivity for solopreneurs and teams - join 100k+ users transforming their operations.

Start your free trial today at i10x.ai and 10x your efficiency.

Today’s Rundown

An updated search fund primer

The search fund playbook

Vision for the search fund model

Project Apex in an overlooked niche

2 deal / launch announcements

Weekly Highlights

Spectra Investment and Cerralvo, both search fund investors, published a joint search fund primer:

Latin America has become one of the most active global search fund markets with 169 funds raised since 2008, including 24 new funds in 2024 alone, leading to 59 acquisitions and 14 exits despite higher interest rates and weak IPO markets

Search fund outcomes remain strong with a 69% acquisition rate, a 3.1x average ROI and a 28% IRR, and even after removing top outliers the asset class still delivers roughly 2.5x ROI and low-20s IRRs

The searcher profile is shifting materially as solo searchers now represent 78% of recent cohorts, non-MBA backgrounds account for 51%, and operators and ex-founders increasingly replace traditional finance and PE profiles

Acquired companies show improving fundamentals with median EBITDA margins of 34%, EBITDA growth of 25% at acquisition, stable valuation multiples, and disciplined deal structures using roughly 37% debt and 8% earn-outs

Partnership-led search funds demonstrate superior downside protection with zero total losses versus 26% loss rates for solo funds, reinforcing that team-based execution meaningfully improves risk-adjusted returns

The SMB Investor published a new podcast episode on inside the search fund playbook:

The traditional search fund model emerged in the late 1980s from Stanford and Harvard as a form of micro-cap private equity with a repeatable playbook, historically targeting businesses around $2–5M EBITDA and delivering long-term net returns cited at roughly 35% annually over four decades

A fund-of-funds strategy provides exposure to hundreds of underlying small businesses by investing in 7–9 high-quality search fund managers, each typically completing 20–25 acquisitions, creating diversification that materially reduces single-deal risk while preserving attractive aggregate returns

Current small business acquisition multiples have compressed to roughly 3.3x EBITDA based on recent broker-reported data, reinforcing the opportunity for multiple arbitrage when businesses are later sold to private equity at materially higher multiples

Value creation in search-driven acquisitions is driven by a combination of modest leverage, operational improvements, and multiple expansion rather than binary outcomes, contrasting sharply with venture-style risk profiles and improving downside protection

Advances in software and AI are expected to significantly improve diligence quality, operational efficiency, and margin predictability, enabling small businesses to compete more effectively with larger firms and further strengthening the long-term attractiveness of the asset class

The three co-founders of search fund Convexo3 shared their vision for the search fund model:

A trio-led search fund structure can materially reduce key-person risk and improve sourcing speed and execution depth, especially when partners have nearly a decade of shared operating history, which investors tend to view as a strength rather than a novelty

Starting the search before completing fundraising created a tangible advantage by allowing analysis of 400 plus companies, building a pipeline where roughly 85 percent of opportunities were proprietary, and entering fundraising discussions with real traction instead of theory

Colombia currently offers an attractive entry point for search funds due to depressed valuations driven by political pessimism, while institutional stability, succession-driven supply of family businesses, and a potential pro-business shift in 2026 create asymmetric upside

High-quality recurring revenue is structurally harder to find than in the US, but mission-critical B2B services such as managed IT, cybersecurity, healthcare services, diagnostics, and specialized distribution can still deliver resilient cash flows through technical and regulatory moats

A disciplined post-acquisition model built on low leverage, clear role separation across CEO, COO, and commercial leadership, and a three-pillar focus on robustness, growth, and optionality increases margin of safety while preserving upside through adjacent, capital-efficient growth

Agame Search Fund, a search fund investor, published the "Project Apex" thesis - how Agame spots value in overlooked niches:

Project Apex is a niche industrial business with approximately $4.3M in revenue and ~$516k EBITDA that benefits from a “mini-monopoly” structure driven by four patents, municipal specification lock-in, and limited competitive replication

Roughly 60% of revenue comes from equipment sales while about 25% is recurring, high-margin aftermarket parts, creating a razor-razorblade model that stabilizes cash flow and increases customer lifetime value

The timing advantage is significant due to a $1.2 trillion U.S. Infrastructure Investment and Jobs Act, including over $1B annually through 2026 for road safety, combined with a 2023 federal mandate requiring higher-spec road markings that directly increases demand for the company’s equipment

The value creation plan targets a 36-month transformation through financial professionalization, expansion from inbound to outbound sales across adjacent states, and a roll-up of regional distributors to scale from a regional to a national platform

The investment thesis emphasizes asymmetric risk with a 3.9x entry multiple, patent protection, legally mandated demand, and government-funded end customers, positioning returns to rely more on structure and execution than on macro growth assumptions

Deal / Launch Announcements

Any suggestions, questions, or criticism? Any topics that should be covered in the future? By answering this email, you’re sliding right into my inbox.